Here in this column you have to enter your full name as per your pan card.

In this second column you have to enter your email address. Email address is necessary because you will get all the notifications related to gst on your email address.

Enter your mobile number in the column. You will receive the OTPs from gst on your mobile number and every other notification issued by the department

Enter your firm name which you want to use on your GST Certificate. This is like your trade name.

Select your type of business entity for example if you are a proprietor then select proprietor. There is a list of other business entities. Select from the list according to your business.

Enter your complete business address. You will be required to provide a business address proof (i.e. Electricity Bill or Rent Agreement or Ownership Documents) for the gst registration purpose.

Enter the list of goods and services currently you are providing to your customers.

From the list kindly select your nature of business activity. You can also select the multiple options from the list.

Enter the date of your business incorporation. It is like the estimate date when you started your business.

Procedure to Get GST Registration Certificate

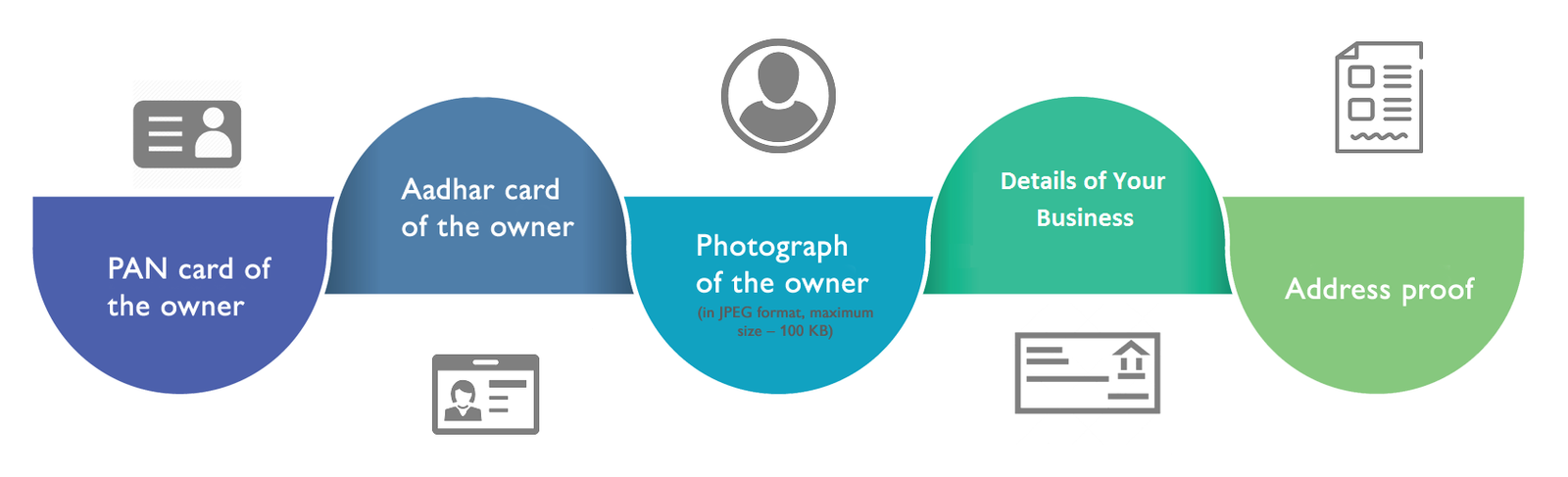

Documents Required for the GST Registration

GST Registration FAQ’s

Registration under Goods and Service Tax (GST) regime will confer the following advantages to the business:

- Legally recognized as a supplier of goods or services.

- Proper accounting of taxes paid on the input goods or services that can be utilized for payment of GST due to the supply of goods or services or both by the business.

- Legally authorized to collect tax from his purchasers and pass on the credit of the taxes paid on the goods or services supplied to purchasers or recipients.

No. A person without GST registration can neither collect GST from his customers nor claim any input tax credit of GST paid by him.

Any supplier who carries on any business at any place in India and whose aggregate turnover exceeds threshold limit as prescribed in a year is liable to get himself registered. However, certain categories of persons mentioned in Schedule III of MGL are liable to be registered irrespective of this threshold.

An agriculturist shall not be considered as a taxable person and shall not be liable to take registration. (As per section 9 (1))

Where the application for registration has been submitted within thirty days from the date on which the person becomes liable to registration, the effective date of registration shall be the date of his liability for registration.

Where an application for registration has been submitted by the applicant after thirty days from the date of his becoming liable to registration, the effective date of registration shall be the date of the grant of registration.

In the case of suomoto registration, i.e. taking registration voluntarily while being within the threshold exemption limit for paying tax, the effective date of registration shall be the date of order of registration.

As per section 2 (6) of the MGL, aggregate turnover includes the aggregate value of:

- all taxable and non-taxable supplies,

- exempt supplies, and

- exports of goods and/or services of a person having the same PAN.

As per paragraph 5 in Schedule III of MGL, the following categories of persons shall be required to be registered compulsorily irrespective of the threshold limit:

- Persons making any inter-State taxable supply;

- Casual taxable persons;

- Persons who are required to pay tax under reverse charge;

- Non-resident taxable persons

- Persons who are required to deduct tax under section 37;

- Persons who supply goods and/or services on behalf of other registered taxable persons whether as an

- Agent or otherwise;

- Input service distributor

- Persons who supply goods and/or services, other than branded services, through electronic commerce operator;

- Every electronic commerce operator

- An aggregator who supplies services under his brand name or his trade name; and

- Such other person or class of persons as may be notified by the Central Government or a State

- The government on the recommendations of the Council.

Any person should take a Registration, within thirty days from the date on which he becomes liable to registration, in such manner and subject to such conditions as may be prescribed.

No. Every person who is liable to take a Registration will have to get registered separately for each of the States where he has a business operation and is liable to pay GST in terms of Sub-section (1) of Section 19 of Model GST Law.

Yes. In terms of Sub-Section (2) of Section 19, a person having multiple business verticals in a State may obtain a separate registration for each business vertical, subject to such conditions as may be prescribed.

Yes. In terms of Sub-section (3) of Section 19, a person, though not liable to be registered under Schedule III, may get himself registered voluntarily, and all provisions of this Act, as are applicable to a registered taxable person, shall apply to such person.

Yes. Every person shall have a Permanent Account Number issued under the Income Tax Act, 1961 (43 of 1961) in order to be eligible for grant of registration under Section 19 of the Model GST Law.

However as per section 19 (4A) of MGL, PAN is not mandatory for a non-resident taxable person who may be granted registration on the basis of any other document as may be prescribed.

Yes. In terms of sub-section (5) of Section 19, where a person who is liable to be registered under this Act fails to obtain registration, the proper officer may, without prejudice to any action that is, or may be taken under the MGL, or under any other law for the time being in force, proceed to register such person in the manner as may be prescribed.

Yes. In terms of sub-section 7 of MGL, the proper officer can reject an application for registration after due verification. However, it is also provided in sub-section 8 of Section 19, the proper officer shall not reject the application for registration or the Unique Identity Number without giving a notice to show cause and without giving the person a reasonable opportunity of being heard.

Yes, the registration Certificate once granted is permanent unless surrendered, canceled, suspended, or revoked.